Good sales performances of wines in the Italian Wine Crypto portfolio reflect positively on the value of IWB tokens. In the last four months (from June 2021) the average value of the IWCB stock had a growth of 3%, which is in line with the expected 12-13% on an annual basis.

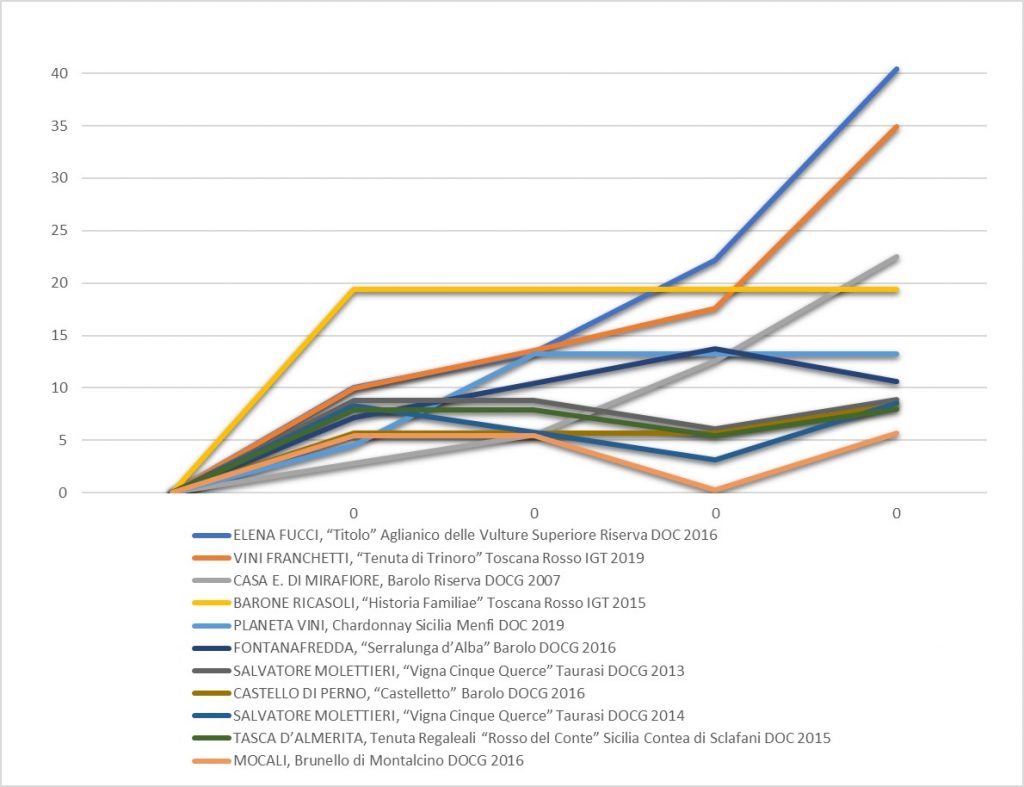

The top 11 performers:

– ELENA FUCCI, “Titolo” Aglianico delle Vulture Superiore Riserva DOC 2016

– VINI FRANCHETTI, “Tenuta di Trinoro” Toscana Rosso IGT 2019

– CASA E. DI MIRAFIORE, Barolo Riserva DOCG 2007

– BARONE RICASOLI, “Historia Familiae” Toscana Rosso IGT 2015

– PLANETA VINI, Chardonnay Sicilia Menfi DOC 2019

– FONTANAFREDDA, “Serralunga d’Alba” Barolo DOCG 2016

– CASTELLO DI PERNO, “Castelletto” Barolo DOCG 2016

– TASCA D’ALMERITA, Tenuta Regaleali “Rosso del Conte” Sicilia Contea di Sclafani DOC 2015

They had 15,75 % growth, which, if confirmed in the last 2 month of the year, permits to expect even more value’s increase for all the stock.

Why the wine value’s increase is highly beneficial for IWB token holders? The answer is simple: each IWB token represents a percentage of the wine stock backing it. If that stock increases its value because of its market appreciation, which is common in investment grade wines, that percentage has a bigger value, that the token holder may receive on a quarterly basis also in the form of additional bonus tokens.